29+ call debit spread calculator

The max profit is usually much higher than the max loss for debit spreads. If we didnt sell the call to create a.

Raising The Bar Call Debit Spread Strategy Payoff Derivation And Illustration

Ad Smart Options Strategies shows how to safely trade options on a shoestring budget.

. Web The Option Calculator can be used to display the effects of changes in the inputs to the option pricing model. It contains two calls with the same expiration but different strikes. Enter the underlying asset price and risk free rate Step 3.

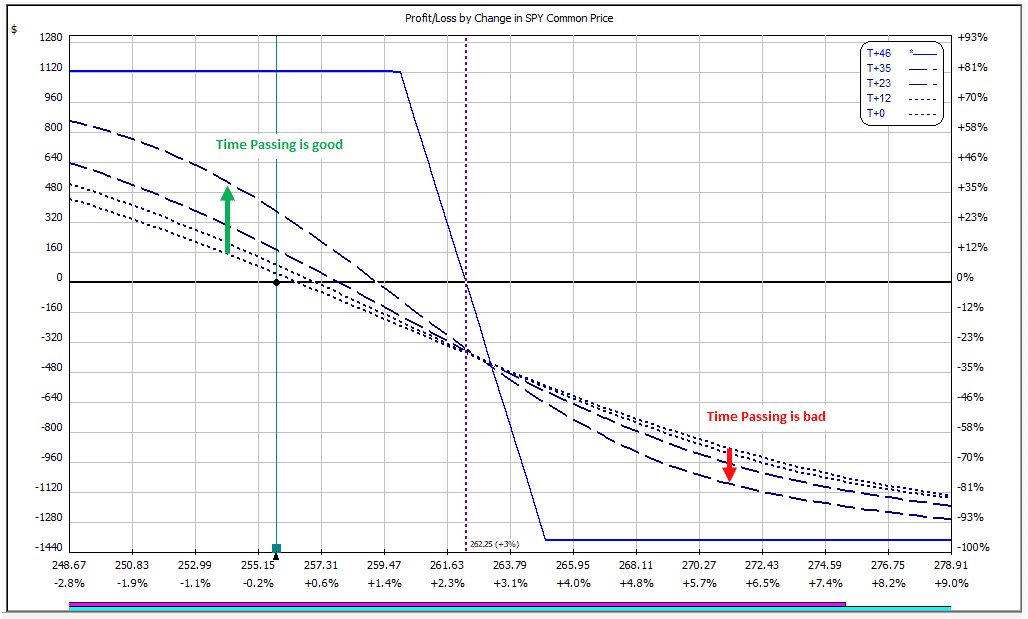

Web Using this information we would open a Call Debit Spread CDS because we are bullish on SPY. What is a bull call spread. Time value decreases as expiration.

Web A bull call spread is a type of vertical spread. Web Bull Call Spread Calculator Search a symbol to visualize the potential profit and loss for a bull call spread option strategy. For example if you buy a call spread with a 50 long call strike price for.

Web To calculate a net theta we would do the same. Ad Stay on top of bills keep funds organized crush your financial goals. Suppose the theta for the January 40 call is -02 and the theta for the January 45 call is -022 then using the same.

Web Add the premium paid to the long call option to calculate the break even price for a call debit spread. To calculate the break-even point of. Web For bearish put debit spreads the breakeven point is calculated by taking the higher strike purchased and subtracting the net debit total for the spread.

The best bull call strategy is one where you think the price of the underlying stock will go up. Select your option strategy type Call Spread or Put Spread Step 2. A debit is paid for the long call and a.

The strike price of the short call is higher than the strike of the long. Try Simplifi for free today. Our max loss on the call debit spread is what we paid for it 15.

Web Bull call spread is a debit spread we pay 708 when setting up the position. The inputs that can be adjusted are. Manage your finances with confidence ease.

Using a bull call strategy you buy a call option and sell. Web The Calendar Call Spread Calculator can be used to chart theoretical profit and loss PL for a calendar call position. Web Dec 29 2021 at 900 AM Debit spreads can be a very consistent options trading strategy.

The next two columns H and I show the value and profit or loss at given underlying price at expiration. Web A Bull Call Debit Spread is a limited risk and limited profit strategy. Download Smart Options Strategies free today to see how to safely trade options.

Web Online Option strategy analyzerStrategy ScreenerScreen for Covered Call Covered Put ScreenerOption PricerOption Calculator. Enter the maturity in days of the strategy. Ad Trade with the Options Platform Awarded for 7 Consecutive Years.

CALL DEBIT SPREAD PUT DEBIT SPREAD How to Calculate. Web This call debit spread is 50-wide the difference between the strikes is 50. Bullish Limited Profit Limited.

Web How to Calculate Max Profit and Max Loss of Debit Spreads The maximum potential profit of a debit spread is equal to the width of the strikes minus the debit paid. To open our CDS we would need to. Open an Account Now.

Web A call debit spread is a bullish options strategy that involves buying a call option and selling a further strike call option. Buy a Call at 345 for 750. Web About Bull Calls.

Vertical Spread Options Strategy Definition And Examples

Simple Interest Rate Formula Calculator Excel Template

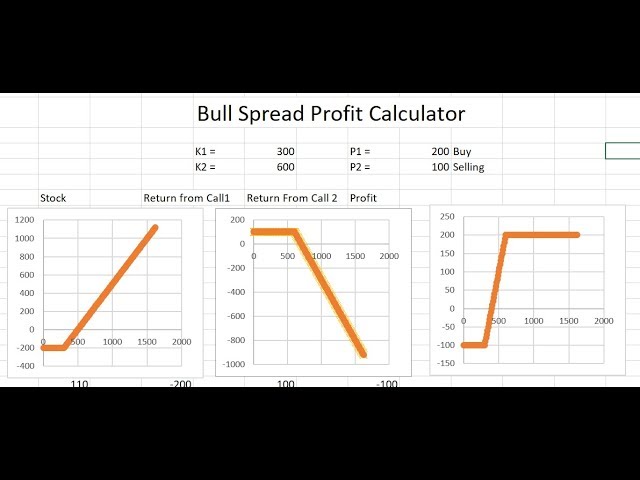

Bull Spread Calculator Youtube

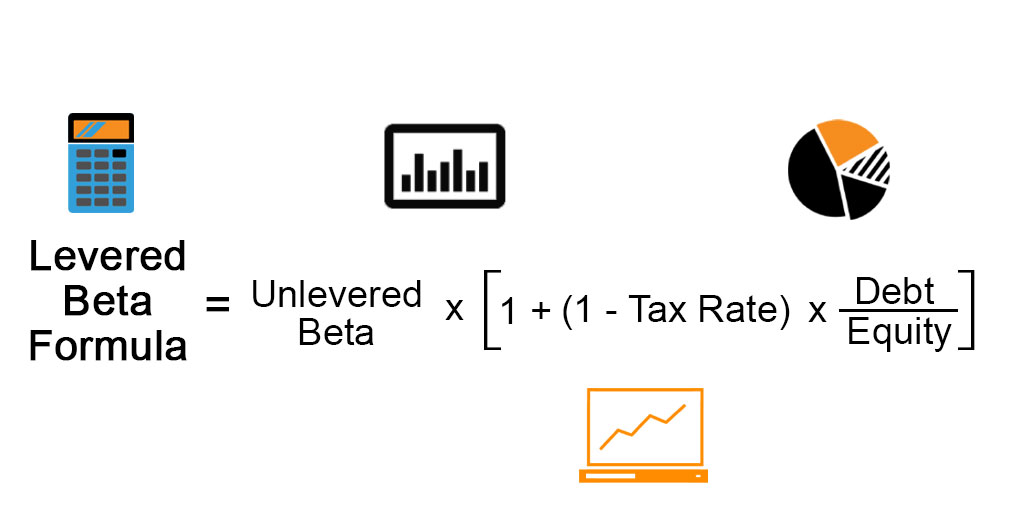

Levered Beta Formula Calculator Examples With Excel Template

Long Call Calculator Options Profit Calculator

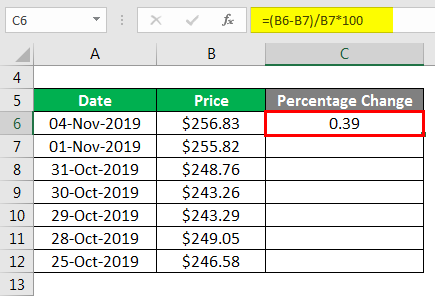

Percentage Change Formula Calculator Example With Excel Template

What Are Options Call Debit Spreads And How To Trade Them

The Ultimate Guide To The Bear Call Spread

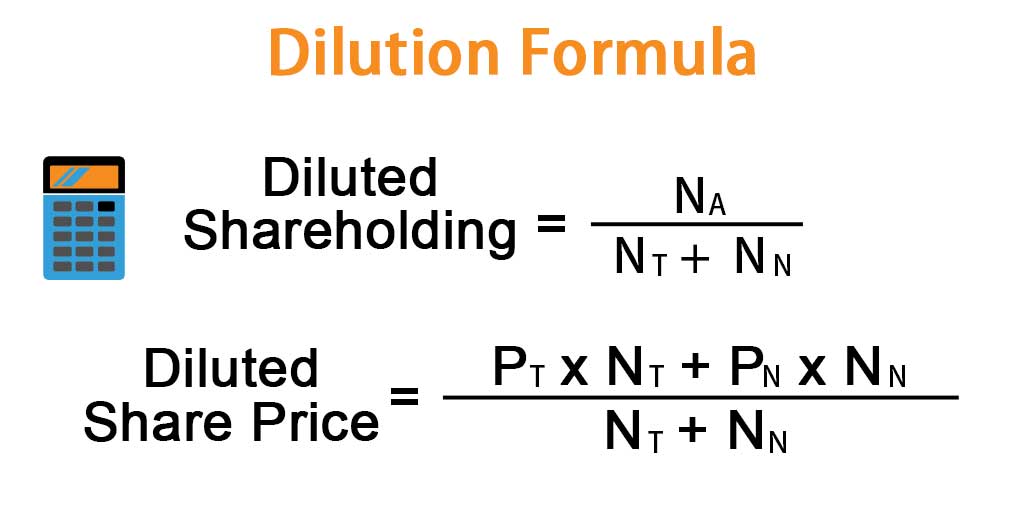

Dilution Formula Calculator Examples With Excel Template

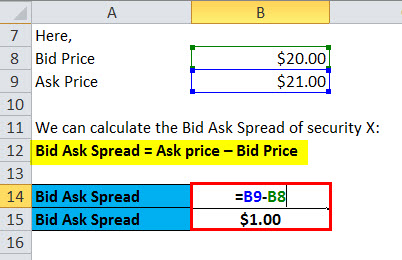

Bid Ask Spread Formula Calculator Excel Template

Using The Free Trade Calculator To Profit On Credit Spreads Option Party

Calendar Call Spread Calculator

Debit Spreads Call And Puts Optionmaniacs

Enterprise Value Formula Calculator Excel Template

Bond Yield Formula Calculator Example With Excel Template

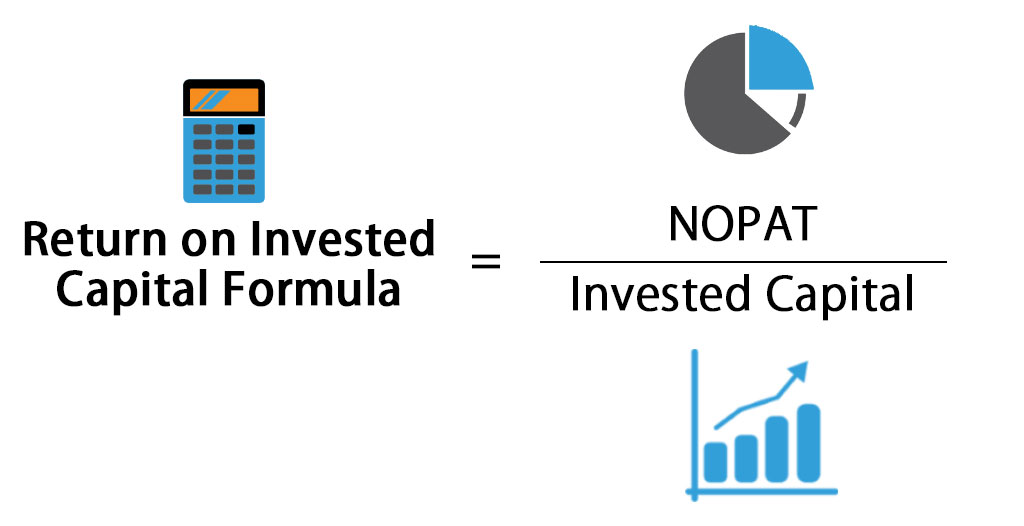

Return On Invested Capital Roic Formula Calculator Excel Template

Option Spread Strategies Bull Call Bear Call Iron Condors